Preparation beats prediction when it comes to investments

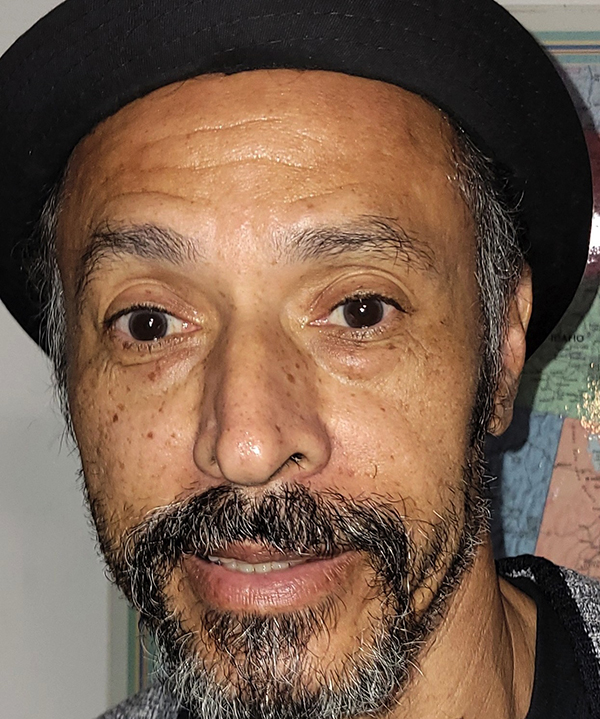

By John Grace

Contributing Columnist

Learning from history is priceless — yet investors seem determined to relearn the same lessons the hard way.

You’ve probably never heard of Jesse Livermore. He ran away from home with just $5, became one of the most legendary traders of all time, and made (and lost) several fortunes.

Livermore was famous not for prediction, but for self-awareness, understanding how behavior and emotion drive decision-making. He saw patterns others missed.

In his 1923 classic “Reminiscences of a Stock Operator,” Livermore wrote: “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Livermore made the equivalent of about $1.5 billion betting against the market in 1929.

Before his final bankruptcy in 1940, he’s also remembered for another timeless line: “I made a fortune getting out too soon.” That quote feels especially relevant today in what I described in an October 2025 Yahoo Finance interview (with a nod to President Herbert Hoover) as “the orgy of everything.” When everything is making new highs, risk hides in plain sight.

In that interview, I suggested Bitcoin may have peaked and could seek lower ground, and that other assets at all-time highs, including stocks, real estate, gold, and silver, could eventually follow, in a Titanic-style fashion. History shows excess rarely deflates gently.

Notice what’s happening now? As the 2025 Santa Claus rally fizzles, Warren Buffett, retiring from Berkshire Hathaway at 95, is sitting on roughly $400 billion in U.S. treasuries while the rest of Wall Street crowds into the AI trade.

Meanwhile, optimism is nearly unanimous. Even perennial bulls admit the lack of dissent is unsettling. As General George Patton once said, “If everyone is thinking alike, then somebody isn’t thinking.”

Here’s the bigger risk lurking in the shadows: retirees. Older Americans now own roughly 80% of the stock market, and unlike younger investors, they may not have time to recover from a significant drawdown. Vanguard’s forward-looking forecasts suggest stock returns over the next decade may be far lower than the past one, a dangerous setup for anyone taking withdrawals.

There are consequences to complacency: overconfidence, overconcentration, ignored volatility and forced selling at the worst possible time. Remember, there were two 50% losses in the same decade. Who can weather that while withdrawing annually?

Prediction won’t save you. Preparation might.

As Buffett reminds us: “Predicting rain doesn’t count. Building arks does.”

The Investor’s Advantage Crash Ark involves four key steps: Define acceptable loss in percentages. Build and monitor portfolios to respect that limit. Use active management; static accounts won’t adapt. And add alternative investments for proper diversification.

You can’t see the future, so you don’t need to call the storm. You need to survive it. The proof is in the planning.

John Grace is a registered representative with LPL Financial. His On the Money column runs monthly in The Wave. The opinions expressed here are for general information only and are not intended to provide specific advice or recommendations for any individual.

LIFTOUT

Older Americans now own roughly 80% of the stock market and … may not have time to recover from a significant drawdown.