LOS ANGELES — A new disaster loan program launched by the Small Business Administration in coordination with Los Angeles County can speed recovery for businesses that suffered damage from looters and other vandals during recent civil unrest. Hundreds of retailers and shops may need the disaster aid.

The SBA recently issued a civil unrest declaration to spearhead a series of low-interest loans of up to $2 million for looted or burned businesses in Los Angeles County after May 26, when thousands of protesters took to the streets to criticize police brutality against Blacks after George Floyd died when a Minneapolis policeman kneeled on his neck on Memorial Day.

Police departments in Southeast Los Angeles County reported eight break-ins with destroyed storefronts, and thousands of dollars in damages, in addition to the shops and buildings set on fire or pillaged in downtown Los Angeles, the Fairfax District, Santa Monica, Beverly Hills, Long Beach and Van Nuys.

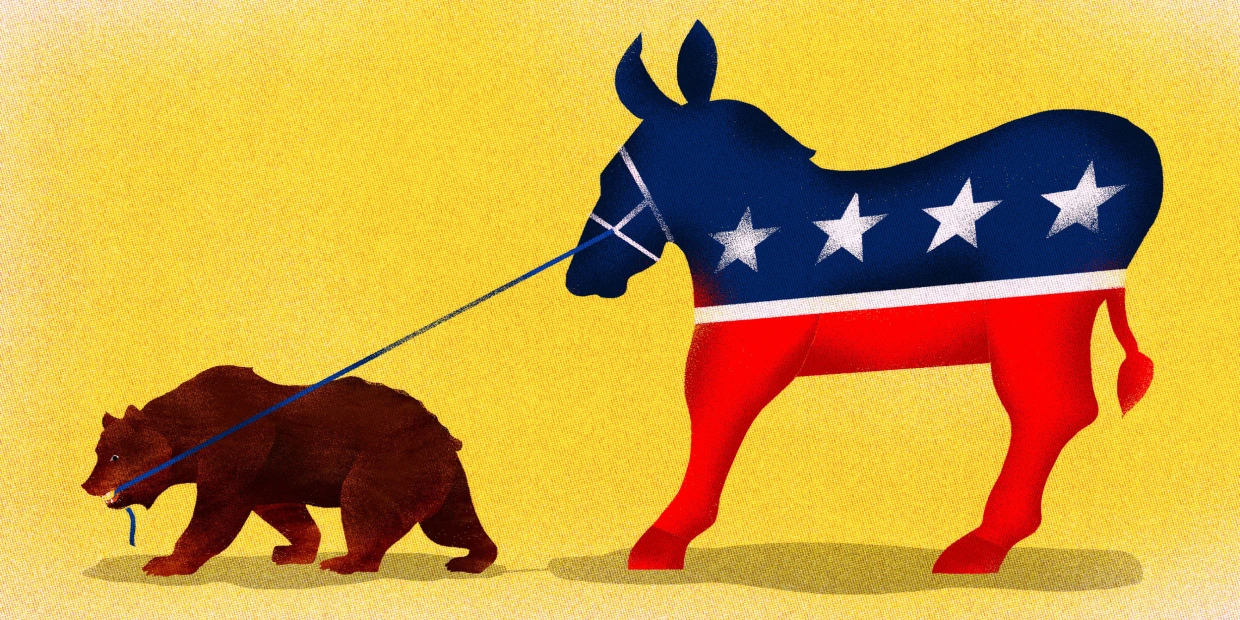

SBA director Jovita Carranza authorized the series of low-interest loans for affected businesses set primarily in Los Angeles County, following a request from California’s Office of Emergency Services Director Mark Ghilarducci, a designee of Gov. Gavin Newsom on the matter.

“SBA is strongly committed to providing California with the most effective and customer-focused response possible, and we will be there providing access to federal disaster loans to help finance recovery for business and residents affected by the disaster,” Carranza said.

There are three types of loans, for businesses, homes and charity organizations at different interest rates depending upon credit worthiness that extend a maximum of 30 years.

For damaged homes, loans whose owners do not have credit lines with banks carry a yearly rate of 1.25%, and 2.5% if they have a credit account, whereas business loans without established credit tack on a 3% interest rate and 6% if they have business accounts with lenders.

The yearly interest rate for nonprofit organizations is 2.7%, whether or not the business has financing with banks.

Kevin McGowan, director of the county’s Office of Emergency Management, is advising business owners with losses to document their cases and start the process of getting disaster relief in an online page.

“Disaster recovery is a multi-layered process, but all efforts always start with clearly capturing the extent of damages and losses suffered in our county,” McGowan said in a statement. “We’ve developed a short online survey tool that both gathers that information and helps us create a registry of business owners so that we can directly communicate with them as future disaster aid resources become available.”

Kristin Friedrich, a representative with the county’s information center, said the agency is counting all the businesses that suffered economic or physical damages during the protests, which could range in the hundreds from mom and pop outlets to large grocery stores.

A Target store in Norwalk reported its glass front doors broken and merchandise stolen with a value of $6,000, while a JC Penney in Downey suffered damage as demonstrators tried to pry open doors that were closed during the coronavirus lockdown on May 30 and 31.

Jaime Moreno, WSS Shoe Store manager in Paramount, said the company’s corporate office handles insurance coverage filings and credit loans, and refused to discuss the amount of physical damages the storefront incurred or the cost of stolen items.

Located near the intersection of Paramount and Alondra boulevards, WSS Shoe store specializes in sports footwear and clothing, and stocks popular brands such as Nike, Adidas, Vans and Converse, selling shoes with the Michael Jordan “Nike Air” signature for more than $100 a pair.

The store remained closed for two days after rioters hurled rocks, shattering storefront displays and glass doors. The days following the incident, employees worked on the premises tallying the losses as customers were told the store would reopen when it posed no injury risks to anyone.

Moreno said he was disappointed the store was targeted by violent protesters.

“To be honest, I was very heartbroken and very sad,” Moreno said. “We hired a company that cleaned and picked up everything damaged.”

Deadlines for business owners to apply for property damage loans are Aug. 17. For economic injury, the deadline is March 17, 2021. Friedrich said applicants in need of help filling forms should contact the county’s Disaster Help Center at (833) 238-4450.

For more information, visit www.sba.gov, or email at disastercustomerservice@sba.gov.

By Alfredo Santana

Contributing Writer