CalKIDS: You May Have a College Fund

Does Your Child Have College Savings They Don’t Know About

The state is directly investing money for low-income students and all newborns to attend college. After two years, the program is still not widely known by the students who need the most financial assistance.

By JACQUELINE MUNIS

CalMatters

Nearly 3.7 million students and 667,000 newborns in California have money invested in a savings account to help pay for college. But most families don’t know the money is there.

UCLA and others are trying to change that.

Last year, UCLA opened the CalKIDS Institute in partnership with the state to boost outreach as well as research the program’s reach and which demographics they should be targeting based on enrollment.

Institute’s director Nayiri Nahabedian said that, ultimately, the point of all these programs is to make college seem like an attainable goal for students and show them that the state, their community and their family believe that they can pursue higher education.

So who gets money? Under CalKIDS, all babies born in California receive a sum. Babies born between July 1, 2022, and June 30, 2023, received $25 deposits, and all babies born after July 1, 2023 receive $100 deposits.

As part of the program, all low-income first grade students receive a one-time deposit of $500. First-graders who are in foster care receive an extra $500 and homeless first graders receive $500 more, totaling $1500 for some students. All the accounts are tax-free, and the money is invested whether or not families claim their accounts.

Additionally, the state spent $1.8 billion in the 2021-22 budget to provide a one-time deposit to all low-income students in grades 1 through 12 in 2022.

Yet, of the 4.3 million student accounts created, only 313,445 accounts have been claimed by families, meaning they have registered online and seen the amount in their accounts. Only 6.3 percent of newborn accounts have been claimed and 7.4 percent of student accounts have been claimed as of March 2024.

The state allocated $22 million in the 2022 and 2023 budgets to market the program. In Los Angeles, Riverside, Fresno, and Sonoma counties, CalKIDS program info is sent to all families that request a birth certificate, according to Joe DeAnda, the director of communication at the State Treasurer’s Office.

During the first three months of this year, registration in the newborn program has more than doubled, from 20,608 to 42,312 newborns.

In April, CalKIDS began targeting high school seniors, through social media, email and direct mail, according to DeAnda. By May, the number of claims among high school seniors increased by 74%.

They have partnered with school districts, such as Hawthorne School District in Los Angeles County, where 87% of seniors have claimed their accounts.

Still, most of the funds for marketing CalKIDS remain unused. The 2023-24 California state budget reappropriated $8 million to CalKIDS for a statewide media campaign, and the Scholarshare Investment Board is currently soliciting proposals for marketing services, which were anticipated to start on April 1, but have not begun.

“If families are not aware of this program, then it’s not going to have the impact that we think it’s going to have,” said Julio Martinez, the executive director of the Scholarshare Investment Board, an agency that runs CalKIDS within the State Treasurer’s Office.

It administers the state’s 529 college savings accounts, which allow families to invest money tax free to cover education related expenses in the future.

For many students, CalKIDS can be coupled with one of more than a dozen local child’s savings account programs in California.

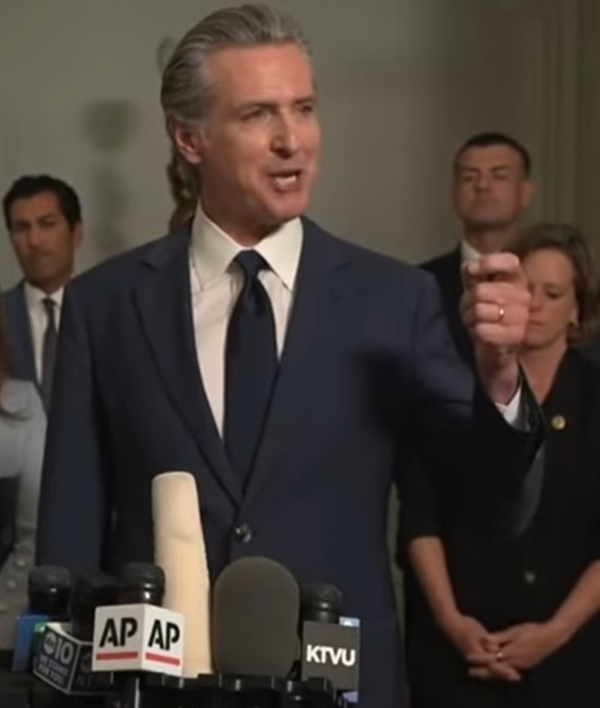

Launched in 2010 by then-mayor of San Francisco Gavin Newson, Kindergarten to College was the first program in the country to include automatic and universal enrollment.

Over the last 14 years, the program has been able to refine its outreach efforts to meet the needs of San Franciscans, said Amanda Fried, the chief of policy and communications at the San Francisco Office of the Treasurer & Tax Collector. Students are eligible no matter their documentation status and can easily make cash deposits into their accounts.

“People have so many things on their plate, and so many competing priorities, and I think a huge mistrust of the financial system, which is totally warranted,” Fried said. “So this program just kind of eliminates so many barriers for families.”

The aim of college savings programs like CalKIDS is not for money deposited by the state to grow enough to pay for college entirely. Rather, the program intends to ease some of the burden of college costs and help students create a college-bound identity.

In addition to registering, students can connect their CalKIDS account to a ScholarShare 529 account where families can contribute their own money, which is invested.

Six percent of claimed student accounts and 35% of claimed newborn accounts have been connected to a ScholarShare 529 account.

According to Martinez, families have on average $2,890 in their Scholarshare 529 account connected via their CalKIDS account.

“For a lot of students [the money] can make the difference between deciding to go and not deciding to go,” said Martinez. “It can be the difference between having a laptop and not having a laptop, having WiFi at home and not having WiFi at home.”

Resources

• See if you or your child is eligible

• Claim your CalKIDS account

• Get answers to frequently asked questions

• Contact CalKIDS for helpJacqueline Munis is a fellow with the College Journalism Network, a collaboration between CalMatters and student journalists from across California. CalMatters higher education coverage is supported by a grant from the College Futures Foundation.

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics. Published with permission of CalMatters.