Credit history remains obstacle for Section 8 tenants

By Robin Urevich

Contributing Writer

In 2020, 62-year-old Callie Rutter was finally ready to move into her own place. After three years of sleeping in her car or signing in and out of grim institutional homeless shelters, Rutter obtained a Section 8 housing voucher to help her rent an apartment.

Third in a four-part series on Section 8 Housing

But everywhere Rutter went, her rental applications were denied.

“It became obvious that my credit history was preventing me from using my voucher,” Rutter told state lawmakers in 2022 as she lobbied for legislation to stop landlords from using credit checks to reject Section 8 voucher holders.

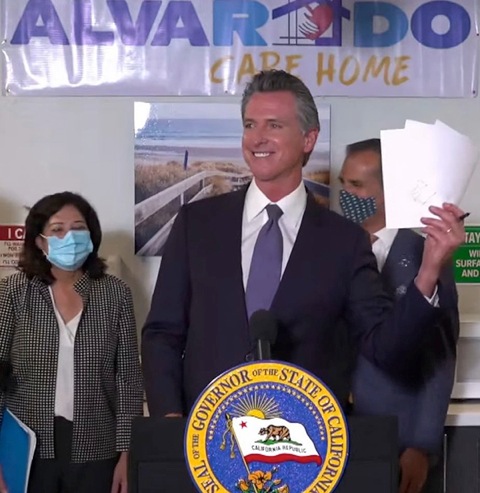

The following year, California lawmakers approved such a law. Senate Bill 267, which took effect in January 2024, prohibits landlords from rejecting Section 8 tenants based solely on their credit history.

They must give applicants the opportunity to provide pay stubs or other “lawful verifiable alternative evidence” they earn enough to pay their share of rent. Colorado adopted a similar measure.

The laws were aimed at removing a major obstacle to the program’s success: Many voucher holders can’t find landlords who will rent to them, even though most of the rent is subsidized. Section 8 tenants pay 30% of their incomes in rent, while the program covers the rest.

But a Capital & Main investigation found some of L.A.’s biggest landlords are flouting the law by continuing to rely on credit history alone to reject Section 8 applicants, and failing to consider alternative evidence of their ability to pay. The news organization hired fair housing testers who posed as renters and inquired about apartment listings at dozens of properties to examine whether the L.A. area’s largest landlords, including Equity Residential, Essex Property Trust, AvalonBay Communities, Prime Residential, G.H. Palmer Associates, Greystar and Jamison Properties, follow the law.

But nearly two dozen buildings whose agents said they accept Section 8 tenants would not consider pay stubs or other evidence of ability to pay in lieu of consumer credit checks as the law requires.

None of the companies agreed to Capital & Main’s interview requests or answered emailed questions. However, spokespersons for Equity Residential, Essex Property Trust, Prime Residential and Greystar said in emailed statements that they abide by California fair housing law.

A Jamison company spokesperson said in a statement that its management companies welcome Section 8 voucher holders. G.H. Palmer Associates and AvalonBay Communities didn’t respond to emails and phone calls.

Nationwide, 4 in 10 Section 8 recipients are unsuccessful at finding a home, according to a 2021 U.S. Department of Housing and Urban Development Study, even after waiting years to be awarded a voucher. In L.A., the failure rate has fluctuated from 30% in 2020 to about 50% in 2022, according to Carlos Van Natter, Section 8 director at the Housing Authority of the City of Los Angeles.

SB 267 is unpopular with landlords and has drawn criticism from the California Apartment Association, a powerful industry trade group. Spokesman Mike Nemeth said pay stubs, bank records and statements of government benefits “do not offer the same insight as a credit report into a person’s financial history or reliability in meeting obligations. This creates challenges for evaluating risk.”

However, the association has informed its members of their obligations under the law in bulletins and in its fair housing training courses for leasing staff.

Still, Capital & Main’s investigation shows that credit history remains a barrier to entry for Section 8 participants.

Beverly Hills-based G.H. Palmer Associates showed the strongest adherence to the law — only one of seven Palmer leasing agents insisted that Section 8 applicants would be required to pass credit checks.

Equity Residential, headquartered in Chicago; Essex Property Trust, based in San Mateo, California; and Charleston, South Carolina-based Greystar have written policies that align with California’s 2024 law on credit history. But when responding to Capital & Main’s testers, leasing agents for those companies described different policies that did not comport with the law, insisting they would reject Section 8 applicants who didn’t pass credit checks.

For instance, at Equity’s Jia Apartments in L.A.’s Chinatown, a Capital & Main tester asked if any applicant had been permitted to show ability to pay rent by presenting pay stubs.

“Not with pay stubs. It’s pretty much with an additional deposit, or they have to go through a guarantor,” the leasing agent said in a phone call.

In all, six of eight Equity leasing agents queried told testers they could be denied a rental based on credit history.

Marty McKenna, first vice president of Equity Residential, said in a statement that “we are confident that we are operating by applicable regulations regarding Section 8.”

At Essex Property Trust, four of the nine leasing agents testers contacted said they would reject Section 8 applicants who didn’t pass credit checks.

But a spokesperson said in an email, “We have reviewed both our written policy and application process and we are in compliance with the law: all Section 8 applicants are approved based on their ability to pay their portion of the rent, not based on credit score.”

A Greystar spokesperson said in a statement that all applicants receive a document that “explains the credit screening process and notes that alternative documentation may be considered in place of a traditional credit check.” But of eight Greystar properties where testers inquired about credit policies, leasing staff at six said they would reject applicants who failed credit checks.

A spokesperson for San Francisco-based Prime Residential, which owns the 4,000-plus-unit Park La Brea apartments in L.A.’s Miracle Mile neighborhood, said in an emailed statement, “We work hard to comply with all applicable state and federal fair housing laws, including seeking alternative evidence of ability to pay rent and never denying Section 8 voucher holders based on credit.”

However a Park La Brea agent said the complex would not accept evidence of ability to pay rent in lieu of credit history. Agents at four other Prime properties told testers they couldn’t say whether credit history would disqualify Section 8 applicants until after credit and background checks were completed.

Jamison Properties, an L.A.-based company, told testers it was not accepting Section 8 vouchers in 16 of 21 buildings, but in the five properties where leasing staff said they did accept vouchers, three would not accept alternatives to credit checks. Two didn’t return tester calls about credit check policies.

A Jamison spokesperson said in a statement that “the management companies overseeing Jamison’s portfolio accept and welcome tenants utilizing Section 8 vouchers and take proactive steps, including engaging a broker and non-profits, to help identify individuals and families who hold vouchers.”

While the company did not answer questions about its credit check policies, its statement said that “all property managers overseeing these buildings have rules and procedures in place to comply with all applicable laws.”.

Chi Chi Wu, director of consumer reporting and data advocacy at the National Consumer Law Center, a nonprofit that advocates for people with lower incomes, said credit history does not predict tenant success.

“It’s especially illogical to use credit reports and credit scores [for vetting Section 8 tenants] because you literally have a program where the government is paying the bulk of the rent,” Wu said. “So you have guaranteed income.”

She noted that many people have poor credit because “something bad happened to them. They lost their job. They got sick.”

At People Assisting The Homeless, an L.A. social services organization, Sasha Morozov, regional director of supportive services, said her group uses tactics similar to Rutter’s in trying to obtain housing for their clients with vouchers. She has not seen greater acceptance of vouchers since the law passed.

“It’s almost like you’ve got to put on your sales hat,” Morozov said, “because the way the market is, that landlord is getting multiple applications.”

Enforcement of the law will be key to its effectiveness, said Deborah Thrope, deputy director of the National Housing Law Project. However, at the California Civil Rights Department, just one attorney and three investigators are charged with enforcing laws that prohibit discrimination against tenants who use government housing subsidies. They investigate and mediate complaints, and at times file suit against alleged violators, but the department’s director Kevin Kish said sparse staffing imposes “a hard limit on what we can do”.

Enforcement could be further limited because many complaints reach California’s Civil Rights Department through local nonprofit fair housing organizations. The Trump administration suspended funding to dozens of such groups nationwide for months earlier this year, causing some to lay off staff and cut back on fair housing enforcement.

Robin Urevich is a reporter for Capital & Main, a nonprofit publication focused on inequality. It is republished here with permission. Reporting for this series was supported by a grant from the Fund for Investigative Journalism.