Pelosi and Waters put focus on child tax credit that offers help for families

By Sue Favor

Contributing Writer

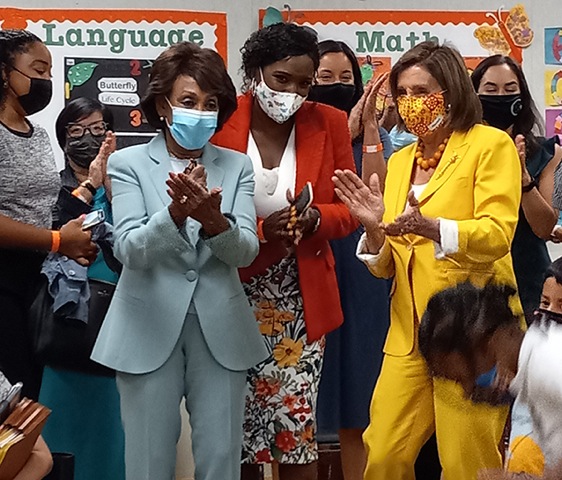

WILLOWBROOK — A program that House Speaker Nancy Pelosi calls “Social Security for children” has already begun paying dividends, she announced last week during an appearance with Rep. Maxine Waters.

Pelosi and Waters, a South Los Angeles Democrat, highlighted the Child Tax Credit, which begun sending money to eligible families in mid-July, Aug. 12 at the Waters’ Employment Preparation Center and the Ethel Bradley Early Education Center.

“There is no doubt that the expanded Child Tax Credit will impact our communities and help put an end to child poverty in this country,” Waters said. “I’m delighted that Speaker Pelosi has joined me in South Los Angeles … to help spread the word about what I believe to be one of the most significant public policies for children and families in the history of our country.”

The American Rescue Plan has increased the tax credit from $2,000 to $3,600 per child for those 6 and under, and from $2,000 to $3,000 per child for ages 6-17. Two-parent households making up to $150,000 will receive the benefits, as will one-parent households earning up to $112,000. Payments will be made monthly through the end of the year.

Almost 89% of the children in Waters’ district will benefit from the credit, which she estimates will lift 18,300 of them out of poverty.

Pelosi said this is the first extension of the child tax credit since 2007, when parents were given a one-time payment.

“This is transformative — this is like Social Security,” Pelosi said. “And (the plan is to) have it this week, next month, next year. It is really a remarkable thing.”

Making permanent changes to the tax credit structure is part of President Joe Biden’s American Families Plan. The proposal, which he introduced in April, calls for broad-based income tax breaks for low and middle-income families; free or lower-cost college tuition; universal pre-kindergarten instruction; paid medical and family leave; help with child care expenses; expanded meal assistance; and health insurance premium reductions.

Pelosi, who said she got into politics with helping children in mind, said that ultimately, the goal is to give mothers and fathers more of a chance to be parents.

“When people have to hold down two jobs to put food on the table … they don’t have time to mentor their children,” Pelosi said. “[The plan] gives them more time to mentor their children, and it’s so important.

Though the American Families Plan has been hailed by Democrats, it will likely be an uphill battle to win Republican support in both the House and the Senate to pass the measure.

Some of Waters’ constituents who have been receiving child tax credits for the last half of the year, are grateful for it.

Anna Maria Gonzales, who attended the press conference with her three small children, said she has used part of her first check to help cover the rent and put more food on the table.

“Jobs that don’t pay enough, and rent is going up every single time — it’s hard,” she said. “I just want to say thank you. It really helps a lot. From the bottom of my heart, I really appreciate it.”

Raven Hinshaw, who was also on hand with her two kids, said the money will open doors for her family.

“We can buy uniforms, and it’s allowed us to sign them up for different enrichment programs,” she said. “It’s been a great help, definitely a big surprise.”

Those who have filed taxes over the past two years do not need to take action, Waters said, as their payments will be made automatically. To sign up, visit childtaxcredit.gov.

Sue Favor is a freelance reporter for Wave Newspapers, who covers South Los Angeles. She can be reached at newsroom@wavepublication.com.