ON THE MONEY: Agility wins in your body, brain and balance sheet

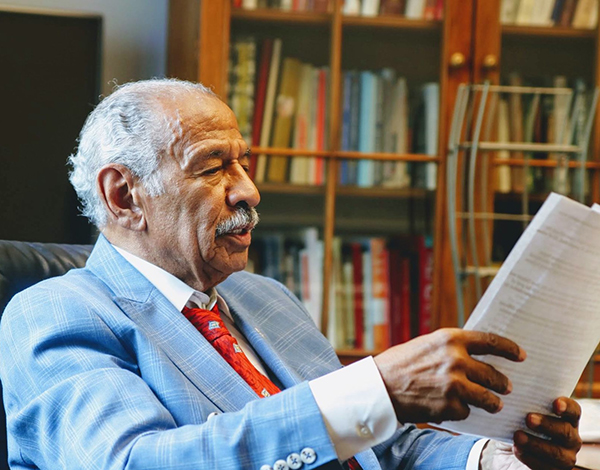

By John Grace

Contributing Columnist

As my parents and my wife’s parents rolled into their 90s, we realized we might have been part of the problem.

We encouraged them to “sit and relax,” thinking we were doing them a favor. Or maybe we were just selfish — too afraid they would fall, break a hip, and wind up with the dreaded “death by pneumonia two months later” headline on our watch.

But neuroscience has a different message: sitting is the new smoking, and if you want to keep your marbles while blowing out 100 candles, you’d better move those hips. One study has shown that just 10 minutes of daily exercise can improve mental performance. Ten minutes!

That’s less time than you spend yelling at the TV news or trying to figure out why your iPhone won’t update. And the more you move (up to a point), the more the brain and body say, “Thank you.”

Exercise can even grow new brain cells. Yes — your hippocampus can bulk up in your 60s and 70s, which means memory loss isn’t an automatic sentence.

Since I personally watched dementia ravage our parents, I’m motivated to move for about an hour almost every day. Consistency is the trick. In fact, a meta-study in Translational Sports Medicine found that even a two-minute aerobic burst at moderate to high intensity boosted attention and learning for up to two hours. Imagine what your brain would do if you jogged through Costco instead of waddling behind the free-sample crowd.

Now, here’s where I connect your quads to your 401(k). The first quarter of 2025 spooked a lot of investors.

An attorney friend told me his portfolio was down 30%. He figured my clients must be screaming bloody murder. Instead, I told him our review showed one client was down just 6%. His jaw dropped.

The difference? He’s in static accounts — 95% stocks and bonds, 5% cash — excellent in good times, but when the market sinks like the Titanic, you get kicked in the assets.

Agility matters. In body. In the brain. And yes, in money.

We’re living in unprecedented times. Immigration policy swings are causing whiplash in the labor market.

Economist Harry Dent points out that immigrants not only work harder, but they also often start businesses, filling unmet needs. Limit that flow, and productivity drops.

Dent forecasts a high likelihood of a significant recession between 2026 and 2028, held back only by the substantial COVID stimulus. Translation: the hangover is still coming. Like drugs and alcohol addictions, the artificial stimulus is subject to the laws of diminishing returns.

Which brings me to Warren Buffett. At 95, with $344 billion in cash sitting on Berkshire Hathaway’s balance sheet, the man is ready to party like it’s 1929. (Last time around, he turned a cool $5 billion loan to Goldman Sachs into preferred stock paying him 10% plus fat warrants — because when you’re Buffett, you don’t buy tickets to the Titanic; you sell the lifeboats.) Be like Buffett by repositioning highly appreciated assets while you can.

I even sent him a note of appreciation recently — not for his fortune, but his wisdom: “Predicting rain doesn’t matter. Building arks does.”

Whether it’s your body, your brain, or your balance sheet, the time for passivity is over. Build your modern ark now. Because storms aren’t a matter of if. They’re a matter of when.

John Grace is a registered representative with LPL Financial. His On the Money column runs monthly in The Wave. The opinions expressed here are for general information only and are not intended to provide specific advice or recommendations for any individual.

LIFTOUT

Economist Harry Dent points out that immigrants not only work harder, but they also often start businesses, filling unmet needs.