By Alfredo Santana

Contributing Writer

LINCOLN HEIGHTS — The Paycheck Protection Program is nearing its May 31 end and My Dream’s Salon owner Gerardo Castellanos knows the opportunity to get a forgivable loan using it to rehire two employees he lost to COVID-19 shutdowns is about to escape.

Castellanos purchased the hairstyle shop on Avenue 26 and Daly Street five years ago, and said the shop had a loyal stream of customers inherited from the previous proprietors who retired after 30 years of running the business.

But like many retailers near his salon deemed nonessential, My Dream’s Salon was hit hard by the coronavirus in March 2020. He had to close down in line with state and city orders to prevent workers and clients from catching the rapidly spreading disease.

Castellanos laid off four hairstylists, and remained shuttered until the shop reopened in February, as a combination of massive vaccinations and a steady drop in infections defeated the wave of hospitalizations and deaths recorded over the winter.

“First, we reopened at 25%, then at 50% capacity. Now we are at 75%, and customers are coming back,” said Castellanos, who leases the commercial storefront for about $1,000 a month. “At this level, we are not making money to make rent.”

Forged to bring relief to ailing businesses willing to retain staff using at least 60% of approved funds to cover salaries stretching from eight to 24 weeks, Paycheck Protection Program loans are forgivable in their entirety if micro business owners, independent contractors, the self employed and owners with 300 or fewer workers demonstrate they operate with losses compared to 2019 pre-pandemic levels.

Initially, the loans went to large and wealthy companies that either made a cash grab or took advantage of lax vetting as the Small Business Administration rushed to put an emergency plan together to throw financial lifelines to retailers, service providers and manufactures whose income suddenly crashed.

Castellanos’s shop is still running due to the owners’ ability to pay 10 months of rent out of pocket worth a bit more than $10,000, and to his vision of covering for the shop as if it were “like a third person” in the family.

According to Womply.com, a website platform for PPP applicants, the initial loan phase from April and May 2020 loaned $342 billion to 1,661,367 businesses, ranging from construction to professional and scientific to health care and food services.

That situation made micro entrepreneurs like Castellanos weary of the program’s intent. He applied for a first-round PPP loan as part of the CARES Act but was rejected. Castellanos acknowledged he did not seek advice from a bank or other financial lender.

An avalanche of criticism against beneficiaries of the lopsided loans followed, prompting the SBA and the Treasury Department to revisit and enforce stricter guidelines that would ease PPP approvals to micro and small business operators.

A second PPP round totaling $320 billion expired in August, with the difference that borrowers could choose to spend the loan in a period from eight to 24 weeks while keeping the operations afloat, giving more flexibility to use non-payroll funds for rent, utilities and other expenses.

Approved in December as part of the Consolidated Appropiations Act, the third PPP loans phase contained $284.5 billion that funded about 400,000 businesses in the first two weeks of 2021, according to the Washington Post.

“I am aware that big companies have received the funds,” Castellanos said. “But I also know of a friend who received $1,000 based on his 2019 [Schedule C 1040] tax returns. It is like a joke.”

Following an initial rash of software and computer glitches that stalled online applications for months, and accusations leveled against big banks for discriminating against micro and small businesses registered by minorities without deep pockets, the SBA authorized nonprofit and private PPP loan processors to load portals with accessible and easier formats.

Limited liability companies like blueacorn.com, smartbizloans.com, go.amuref.com/ppp and womply.com/ppp sprung up in response to the crisis, and they have processed hundreds of thousands of PPP loans in favor of independent contractors and micro entrepreneurs by using community development financial institutions as main lenders.

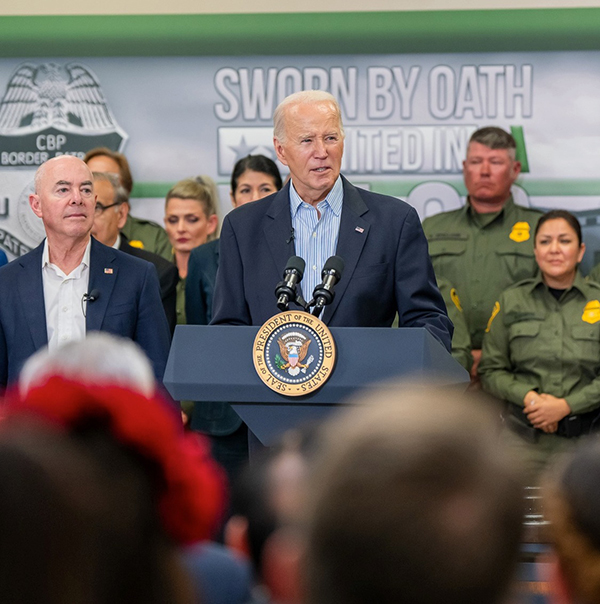

President Joe Biden announced in February that business owners with a history of delinquent student loans already covered, and legal non-citizens with lawful U.S. resident status can use individual taxpayer identification numbers to apply for help through the Paycheck Protection Program.

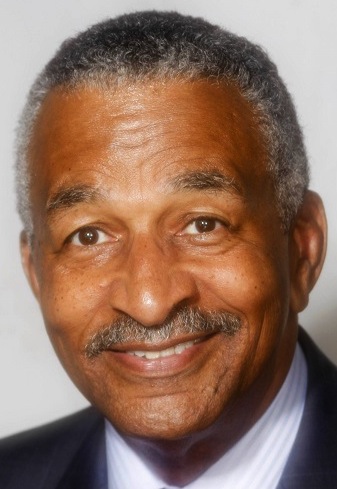

Ron Galati, an SBA representative in the Orange County/Inland Empire branch, advised applicants who applied for a loan using a big bank to cancel the petition if they have not received an SBA earmarked notice, and reapply in any of the online platforms.

“Funds in big branch banks like Chase or Wells Fargo may have run out,” Galati said. “[On May 11], there were about $6 billion still available with community financial institutions. Now there may be $4 to $5 billion,”

The website companies offer scenarios for eventual forgiveness of the loans and how a “second draw” can be forgiven if the business received a first loan if businesses can demonstrate a 25% or more income loss during the first, second or third quarters of 2020 matched to those of 2019.

PPP loans center on criteria of an amount of up to 2.5 times monthly wages earned the previous year of the pandemic, which is tabulated by gathering the gross yearly income, divided by 52 weeks, and multiplied by 10.

For second drawers, loans are quantified using a formula that demonstrates a 25% reduction on receipts in any of the three quarters of 2020 compared to the similar period of 2019.

In case a loan does not qualify for forgiveness, an interest rate of 1% fixed rate applies and the money will be due in five years after disbursement.

There is an important caveat. Applicants receiving unemployment benefits can qualify and receive a PPP loan, but they cannot use money from both funds at the same time to cover personal wages.

“There is no restriction on receiving both benefits, but as a general rule you should not use your PPP loan to cover your own compensation while at the same time receiving unemployment benefits,” wrote Catherine Weiss along a group of attorneys with the firm Lowenstein Sandler.

“If you are receiving unemployment benefits, you can use your PPP loans for other business expenses, such as other employees compensation, rent, mortgage, interest, utilities operating costs, property damage costs and supplier costs.”

Galati advised loan recipients to consult with a professional tax advisor, or certified public accountants to itemize PPP expenses before requesting loan forgiveness soon after the money runs out.

For his part, Castellanos said he would reconsider filing for a PPP loan before the looming deadline if customers hold off from getting haircuts, with a projected rent increase as part of the lease agreement later this year.

“Sometimes we have up to three customers waiting for a haircut,” Castellanos said. “Now we serve about eight to 10 customers a day, and before the pandemic we had an average of 15 to 20. I feel like I’ve paid the due rent and I am restarting again.”

Alfredo Santana is a freelance reporter for Wave Newspapers who covers the Southeast Los Angeles County area. He can be reached at alfredo68j@hotmail.com.