THE HUTCHINSON REPORT: One year after the flames, Altadena still suffers

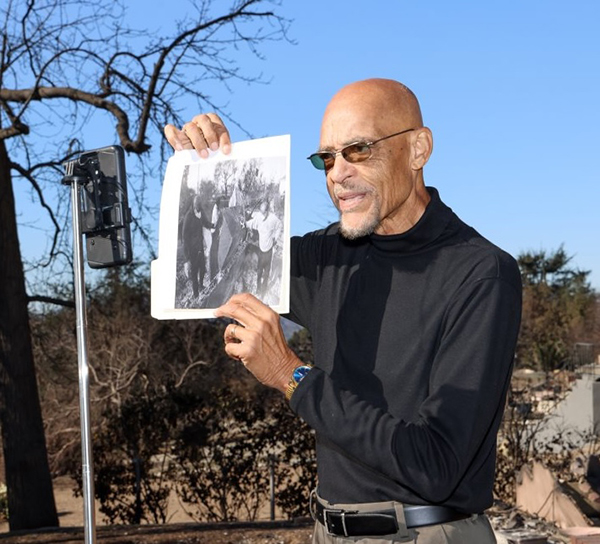

By Earl Ofari Hutchinson

Contributing Columnist

One year ago, Altadena burned. One year later Altadena still burns.

This time it’s not from death-dealing, high wind-sped flames. It burns from insurers who either drag their feet on home repair payments, offer low-ball payments, or simply deny homeowner claims.

It burns from Los Angeles County officials who still won’t admit that they horribly fumbled the ball in not promptly informing the mostly Black residents of West Altadena of the fire danger. It burns from the mountains of paperwork and red tape that residents who seek to rebuild confront when applying for building permits.

It burns from a motley assortment of scammers, developers and opportunists of all stripes who are gobbling up destroyed homes and their lots at bargain basement prices. It burns from the continued shortage of affordable temporary live-in rentals for many of the residents left homeless.

It burns from a media that focuses maximum attention on the mostly white, upscale Pacific Palisades fire devastation and not the mostly Black working class Altadena’s fire devastation.

The discontent, even anger, among many of the residents is more than justifiable A survey by a local nonprofit found that fewer than 20% of those burned out said they had any hope of being able to move back into their rebuilt homes within the next year.

The biggest obstacle remains money. Lots of it is needed to rebuild. The finger of blame can be pointed squarely at home insurers. The Black fire victims in West Altadena face the same dilemma that many other Black homeowners face in the past and present. Namely, getting fair and equitable access and pricing for their home insurance coverage.

After the fires, the widespread assumption was that every homeowner whose home was damaged or destroyed had homeowner insurance. That was hardly true.

Millions of homeowners nationally are uninsured or grossly underinsured. A disproportionate number of them are Native American, Latino and Black. The majority are lower income.

A Consumer Federation of America study in 2024 found that uninsured property accounted for more than 7% of all properties in the country. The dollar amount totaled $1.5 trillion in property value that was unprotected. In 2021, a study found that the uninsured dollar total for Black-owned homes totaled a whopping $200 billion.

The report concluded: “Being uninsured can foster deeper economic [insecurity] for millions of homeowners across the country, especially those with lower incomes, and it is an important contributor to racial inequality.”

It further noted that being uninsured was yet another major contributor to increasing the racial wealth gap, as uninsurance disproportionately impacted Latino, Black, and Native American homeowners.

The troubling and persistent question is just how do insurers get away with not providing accessible and equitable priced coverage to so many minority homeowners, especially lower income homeowners? Numerous studies and testimonies from those in and outside the insurance industry provide an answer to that question.

They tick off the many ploys and tactics that are used to slam the insurance coverage door shut for millions. Here is the checklist of the dodges compiled by the Consumer Federation of America.

Many insurers:

• Offer insurance policies with inferior coverage.

• Do not return calls or requests for information from consumers interested in getting policies.

• Impose different terms and conditions based on someone’s neighborhood.

• Refuse to write policies for homes in those neighborhoods.

• Refuse to underwrite buildings based on age, which often disproportionately impacts mostly Black neighborhoods.

• Require inspection reports in certain areas but not others.

• Provide fewer or inferior options compared to wealthier neighborhoods.

• Discourage applicants from applying for coverage in predominantly Black and Latino neighborhoods.

At the same time, Black and Latino homeowners are far more likely to have an underinsured home. That is true for many homeowners in West Altadena.

A study found that nearly three-fourths of the homes in that area are underinsured. The operative term home insurers use is “severely underinsured.” Nearly 40% of the homes fall into that category.

In hard dollars and cents, the estimate is that on average it will cost a minimum of $1 million to completely rebuild a home that was completely destroyed.

Many Black homeowners in West Altadena face the same problems that other Black homeowners face in the aftermath of a natural disaster. Do they have adequate, or any insurance? Will their insurer fulfill their obligation to make timely and adequate payments to cover the cost of repair? Will they be able to make repairs on a speedy basis?

Then there is the larger question that many grapple with. Is it even worth the time, cost and effort to repair and rebuild their home?

There certainly has been no shortage of developers, speculators and real estate interests who have flooded the area with solicitations and made countless phone calls to many of the homeowners dangling cash offers to buy their property at sums far below market value. Many homeowners have taken the money, pulled up stakes in the neighborhood and started over somewhere else.

The brutal reality is that many Black homeowners are literally left out in the cold in restoring their homes and lives. The agony for them is that one year after the flames Altadena still burns.

Earl Ofari Hutchinson is an author and political analyst. He hosts the weekly news and issues commentary radio show “The Hutchinson Report” Wednesdays at 6 p.m. at ktymgospel.net and Facebook Livestreamed at https://www.facebook.com/earl.