By Alfredo Santana

Contributing Writer

LOS ANGELES — A slowdown in construction material sales that began in December has delivered to Sergio Ramirez’s business an income blow reminiscent of the early COVID-19 pandemic days.

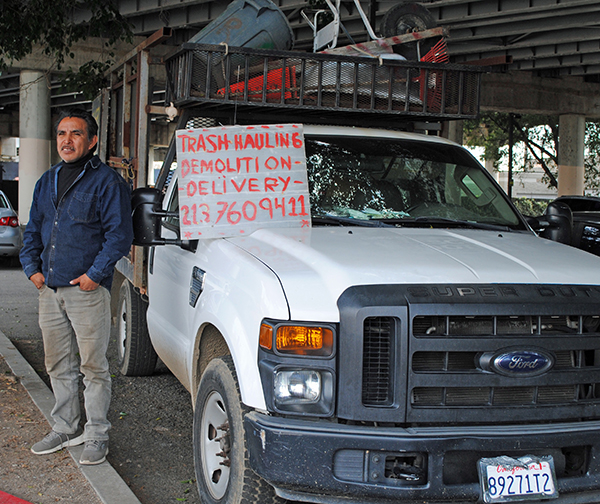

Ramirez is the owner of R/H Transport, a micro enterprise of trash hauling, demolition and delivery services for hire in the parking lot of Home Depot’s Cypress Park store.

And when he learned of a program sponsored by the county Department of Economic Opportunity that grants $2,500 to business owners financially impacted by the lingering pandemic, Ramirez thought that he would be a good candidate for a grant.

Ramirez recalled that his sister-in-law died of COVID-19 and he fell ill at the outset of the pandemic when California Gov. Gavin Newsom ordered businesses to close in March 2020 to contain the spread of the virus.

“I got sick in March, and decided to travel to Mexico for three, almost four months to recover along with my wife,” Ramirez said. “All that time I did not make any money. And when I came back, customers did not want to hire us. They kept their distance.”

Pandemic-burdened micro businesses like R/H Transport, registered in cities within Los Angeles County, able to show in 2019 income tax forms that they earned less than $50,000 in gross revenues and employed less than five full-time workers can qualify for the special grant.

Karie Armstrong, an advisor with the Small Business Development Center, said another requirement is that all micro, small and nonprofit businesses had to be established before December 2019, had a license and are currently active.

Armstrong encouraged potential applicants to enroll in one-hour online webinars available in English and Spanish this month, where they can participate in sessions to answer questions about how to apply, documents needed and to get tech support to upload forms and pictures.

“The role of the SBDC on this is to help you through this process to see if you are available for this grant,” Armstrong said. “You will learn of things that may help you qualify or disqualify for this grant.”

Though the application is fully in English, Armstrong said that the center is ready to assist business owners in 15 languages with guides in English, Japanese, Cantonese, Spanish, Russian, Tagalog, Armenian and Korean, among others.

“Through no fault of their own, small businesses and microbusinesses were devastated during the pandemic, and many continue to struggle to recover,” county Supervisor Janice Hahn said. “With these grants we are going to shore up these businesses, preserve what these small businesses owners have worked so hard to build, and save jobs in our communities.”

Other caveats are that they had not received awards, or are excluded to participate in the California Small Business COVID-19 Relief Grant Program, are not financial institutions, engaged in unlawful activities, are not liquor stores or cannabis enterprises, or buy and sell stocks.

Businesses doing political or lobbying activities, or dedicated to promoting the sale of sexual or prurient acts are not allowed to participate.

Recipients of the forgivable Paycheck Protection Program loans and the low-interest Economic Injury Disaster Loan are welcomed to apply if they meet additional criteria, Armstrong said.

The Economic Opportunity Grant Program rollout includes two phases. Phase one is designed to receive applications from micro entrepreneurs through Feb. 23.

Phase two is a more robust program targeting small business that took a financial blow from the pandemic, have brick and mortar facilities and grossed less than $2 million in either 2019, 2020 and 2021.

For charities, the income was set at a maximum of $5 million. The second phase opens on Feb. 23, and will run through May 20.

Nonprofits focusing on providing training skills for youth ages 16 to 25 will be prioritized to get grants worth $10,000 to $25,000, according to the Economic Opportunity Grant Program’s website.

A total of 6,800 awards would be disbursed using $54 million from the American Rescue Plan funds. The Department of Economic Opportunity estimates that it will distribute 4,600 grants worth $2,500 to micro enterprises.

Armstrong said businesses receiving grants should use the money to cover debt incurred during the pandemic, invest in working capital, pay for business and renewal permits, and to comply with COVID-19 sanitary restrictions.

Since the awards come from public funds, recipients should document how they spend the allocations in case they are audited, Armstrong said.

“L.A. County’s small business and nonprofits are anchors to our local communities and kept us safe and connected during the pandemic, but they continue to struggle as we start to recover,” said Kelly LoBianco, director of the Department of Economic Opportunity. “Now it is our turn to help through the Economic Opportunity Grants program.”

Though highly reduced, the virus’ presence with menacing variants and a resilient high inflation are posing tough challenges to business proprietors like Ramirez.

Below the Golden State (5) Freeway bridge crossing North Figueroa Street, Ramirez explained that he operated two trucks to remove broken concrete, clean up garages and carry loads of plywood sheets, sand, bricks and cinderblock to construction sites before the coronavirus gutted his business.

Today, he mostly works on a 2008 Ford F-250. A diesel truck he owns needs an expensive overhaul to pass the Department of Motor Vehicle’s smog test, and has been idle for at least two years.

Ramirez does not have the cash to make repairs he estimates will run several thousand dollars.

But if he gets lucky and gets a grant, Ramirez said he would invest the money to upgrade his diesel truck, or give a down payment to buy a new unit.

Ramirez blamed rising prices for the drop in purchases home and apartment owners are making now compared to November, when he kept busy nearly at 2019 levels.

According to the U.S. Labor Department, inflation ran at 6.5% a year in December, and consumers spent 0.4% less on construction than in November 2022.

Fewer home repairs and construction purchases reflect in decreasing delivery and rubbish cleanups for Ramirez.

Last week, Ramirez said he made $450, and on Feb. 3 at 2:30 p.m., he had a bulky item run that earned him only $30.

“I pay rent in Los Angeles,” Ramirez said. “Fridays used to be good days to load and deliver construction materials. Now it’s slow.

“One has to stay upbeat to get hired. The catch here is to get a few bucks and stay afloat, not to get discouraged.”