Wave Wire Services

LOS ANGELES — Fast-food workers across the state are celebrating a boost to their minimum wage thanks to a new California law that took effect April 1, but some large chains were considering hiking prices on their menu to cover the costs.

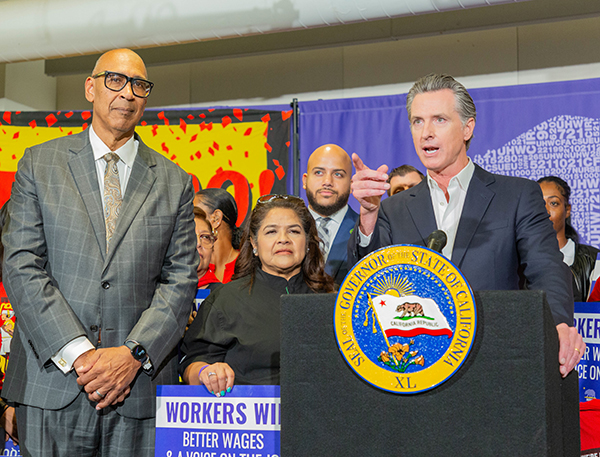

The minimum wage jumped to $20 an hour for fast-food workers. Backers of the measure — including Gov. Gavin Newsom — have called it essential to provide workers with a livable wage, but restaurant industry officials warned that it could lead to increased prices for consumers, or an increase in the use of technology that could impact jobs.

During a virtual news conference April 1, representatives of the Service Employees International Union, which represents about 2 million workers in health care, public sector and property services, and the New York-based Roosevelt Institute think tank insisted that restaurant chains can absorb the increased labor cost without need for raising prices or eliminating positions.

The institute issued a report last week concluding that higher wages do not have to translate to higher prices and fewer jobs.

“There is one big reason why that is, we actually point to it in our report,” said Ali Bustamante, deputy director of Worker Power and Economic Security at the Roosevelt Institute. “We find that prices over the past 10 years, over the past decade, in the fast-food industry increased by 46.8%, compared to 28.7% overall (in the restaurant industry).

“One of the reasons that the prices have gone up a lot faster in the fast-food industry relative to other industries is the fact that markup has also gone up, which is basically the difference between prices and the actual operation costs that businesses incur in order to render their prices,” Bustamante added.

The most “unrealistic assumption” puts the cost of increasing the minimum wage at $4.6 billion, Bustamante said. Excess profits that corporations are taking home could easily pay for it.

The institute’s report found that many fast-food workers in the state had already begun to earn more than $16 an hour or more, and the increase to $20 an hour for some fast-food operators will not be an automatic $4 increase for each worker.

Angelica Hernandez, a fast-food worker represented by SEIU, said the increase will help her breathe a “little easier” in terms of paying her rent and buying groceries. She said the wage bump is a “huge raise” and that she and her colleagues will continue to fight for better wages and working conditions.

Representatives for Chipotle, McDonald’s and Jack in the Box did not immediately respond to a request for comment, nor did officials with Yum! Brands, which owns Pizza Hut and other fast-food companies such as Taco Bell and KFC.

Industry representatives, including the California Restaurant Association, had indicated that the wage increase would be burdensome to some owners, noting that many fast-food outlets are operated by small business owners under franchise agreements with restaurant chains.

During an earnings call in February, Chipotle’s chief financial and administrative officer, Jack Hartung, had said the company would need to impose a “mid-single-digit price increase” in California to cover the wage increase.

Chipotle has yet to make an official announcement on new prices and other fast-food companies such as McDonald’s, Jack in the Box, and Starbucks have also said they are considering increasing their menu items or changes in their operations.

At some Southland Starbucks locations, prices of select individual drinks went up April 1, some by as much as 50 cents.

The Los Angeles Times reported that McDonald’s was “exploring several ways to counterbalance the increase in labor costs and yet to decide how much it will raise the price of the menu items at its corporate-owned stores.”

The company provides “informed pricing recommendations” for its franchise locations, but final pricing is at the discretion of franchisees.

Jack in the Box CEO Darin Harris said the company would depend on upward price adjustments, expecting menu prices to increase from 6% to 8%, Nasdaq reported in early March.

Starbucks officials told The Times that the company “elected to increase wages for all employees regardless of their level of experiences.”

Two Pizza Hut operators had previously announced plans to lay off more than 1,200 delivery drivers in Los Angeles, Orange and Riverside counties to prepare for the minimum wage boost. Pizza Hut franchises planned to pivot toward third-party apps like DoorDash, GrubHub and UberEats for pizza and food delivery.

Yum! Brands previously stated “its franchisees independently own and operate their restaurants in accordance with local market dynamics and comply with all federal, state and local regulations while continuing to provide quality service and food to our customers via carry out and delivery.”

Michael Reich, a professor of economics at UC Berkeley and the chair of the Center on Wage and Employment Dynamics, pushed back against the narrative that fast-food companies need to increase prices to cover wage increases.

He described the fast-food industry as “very healthy and growing fast.” Reich said “sales have gone up and of course profits have gone up as well,” but wages have lagged compared to the wages for the top 20% of the workforce. Reich also warned that when discussing minimum wage increases and price hikes, the two are correlated, but not necessarily a causation.

For example, he noted, according to McDonald’s reports for its fourth quarter and full year results in 2023, the company’s gross profit was more than $14 billion, a 10.26% increase from 2022. Global comparable sales have grown 9% in 2023, and over 30% since 2019, as well, he said.

“Our global comparable sales growth of 9% for the year is a testament to the tremendous dedication of the entire McDonald’s system,” McDonald’s President and CEO Chris Kempczinski said in a statement issued in February.

“Strong execution of our Accelerating the Arches strategy has driven over 30% comparable sales growth since 2019 as our talented crew members, and the industry’s best franchisees and suppliers have demonstrated proven agility with a relentless focus on the customer. By evolving the way we work across the system, we remain confident in the resilience of our business amid macro challenges that will persist in 2024.”

Chipotle’s fourth quarter and full year results in 2023 also showed growth, as total revenue increased by 14.3% to $9.9 billion from 2022. The company also opened a total of 271 new restaurants, according to a company statement.

Last year “was an outstanding year where we delivered strong transaction growth driven by throughput and menu innovation, opened a record number of new restaurants, surpassed $3 million in [average-unit volume] or how much chains are earning per store measured on a mature base and formed our first international partnership,” Brian Niccol, chairman and CEO of Chipotle, said in a statement issued in February.

The law, Assembly Bill 1228, boosts fast-food workers’ earnings from the state’s minimum wage of $16 per hour to $20 per hour. Additionally, the law also establishes a Fast Food Council, representing a path forward to resolve “employer-community concerns while preserving fast-food workers by securing a seat at the table to raise standards,” according to the office of Assemblyman Chris Holden, D-Pasadena, who introduced the bill.

The council will consist of nine voting members, consisting of representatives of the fast-food industry, franchisees, employees, advocates, one unaffiliated member of the public and two non-voting members, who will provide direction and coordinate with state powers to ensure the healthy, safety and employment of fast-food workers.

Responsibilities of the council will also include development of fast-food worker standards, covering wages, working conditions and training.

AB 1228 will impact more than 550,000 fast-food workers and about 30,000 restaurants in the state, officials said.