By Teri Williams

Guest Columnist

Do you lock your front door at home? Do you lock your car at night? Well heads up: You should protect your identity, too.

As we increase the use of digital wallets and tools, such as CashApp, Zelle and Venmo, we need to protect our identities and know what to do if our identity is stolen. Identity theft can impact your wallet, even if it’s for a brief period of time until your funds are reimbursed.

Here are 10 key tips for protecting your identity:

1. Don’t be “Phished!” Phishing is an attempt to acquire sensitive information through email or text. Even if you think you received an email that appears to be from a bank or a service provider like Netflix or Amazon, go directly to their mobile app or website, login and access your account that way, rather than clicking the link in the email or text you receive.

Other phishing attempts include:

• Pressure to act immediately after an alarming phone call, email or text that plays with your emotions. Scammers may pose as an employee from a familiar organization and say there’s a problem that needs immediate attention, but do not act unless you have verified that the person who has contacted you and that the story or request is legitimate.

• Requests for payment to resolve fraud through gift cards, debit cards, money transfers or other unusual ways. Banks will never ask you to transfer money to anyone, including yourself, and will never ask you to transfer money because fraud was detected on your account.

• Offers of a free product or “get rich quick” opportunity that seems too good to be true. If something sounds too good to be true, it probably is. Never cash a check for someone you don’t know. Share this valuable information with your parents or grandparents. Our elders may be duped by phishing.

2. Create strong, unique passwords. Your password should be at least eight characters long with a mix of upper and lower case, and should include numbers and special symbols. To further secure your accounts, set up two-factor authentication. Also don’t share your passwords with anyone, including family and friends.

3. Make sure your apps are trusted and up-to-date. Verify that every app you download is reputable. If you can’t determine whether it’s from a trusted source, don’t install the app. Update your software, especially for your phone and apps, to prevent hackers from using already-known security risks. For security, updates matter.

4. Install antivirus software. To prevent, detect, block and remove viruses, malware and ransomware, you need antivirus software. A computer without one can get infected easily just by connecting to the internet.

5. Beware of unknown email attachments and unfamiliar websites. A rule of thumb is if you do not recognize the sender or their URL, don’t open it. Hackers are always designing deceitful and tricky links or attachments with viruses.

6. Be cautious when connecting to unsecured, public wi-fi networks. Cybercriminals spy on public wi-fi networks and intercept data transferred across the link. If public wi-fi is the only option, use a VPN to protect yourself.

7. If your identity is stolen check your credit report immediately. If you’ve learned that your identity is stolen, check your credit report immediately at www.annualcreditreport.com, a source for free credit reports. Authorized by federal law, this website provides a free credit report from all three credit bureaus. Make sure someone has not already obtained credit with your confidential information. Notify the credit bureaus and/or any creditors if someone has fraudulently obtained credit in your name.

8. Place a “freeze” on your credit report immediately. If your identity has been stolen — even if someone has not yet used your identity to obtain credit — a freeze will require any creditor to contact you before approving a loan. Simply visit www.annualcreditreport.com and select each of the credit bureaus to place a freeze. When you apply for a loan, an apartment lease or insurance, you will need to unfreeze your credit report.

9. Review your bank statements. Your identity may be used to make unauthorized transactions, using your bank account. It’s important to check your bank statements immediately and monthly. Report any unauthorized transactions to your bank.

10. Change your passwords. Update your passwords if you believe any of them have been compromised. Make sure your new passwords are at least eight characters long, with a mix of upper and lower case, and include numbers and special symbols. To further secure your accounts, set up two-factor authentication.

Banks know that keeping your personal information secure is essential, which is why banking institutions are dedicated to maintaining a secure online environment with state-of-the-art cybersecurity methods. To further protect your identity, take these steps today.

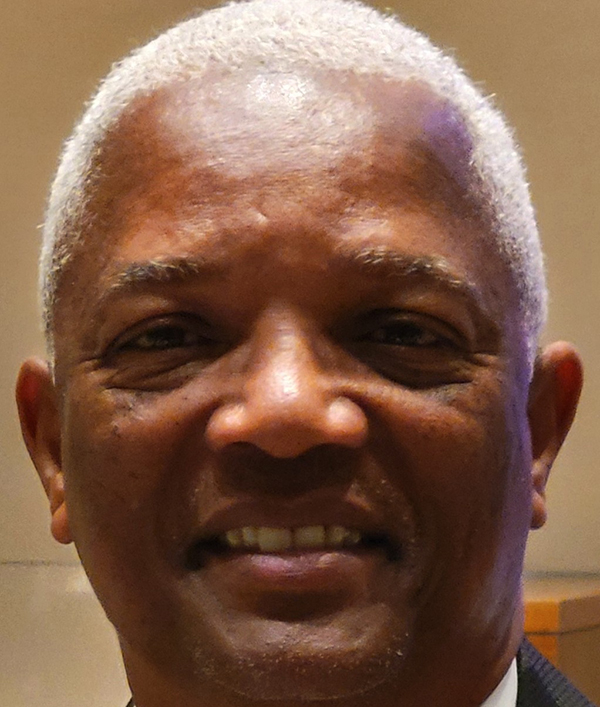

Teri Williams is the president and chief operating officer of One United Bank, the largest Black-owned bank in the United States.

LIFTOUT

Identity theft can impact your wallet, even if it’s for a brief period of time until your funds are reimbursed.